Today, I’m going to teach you to balance your checkbook. This is the key first step that’s going to underpin everything else we’ll learn here.

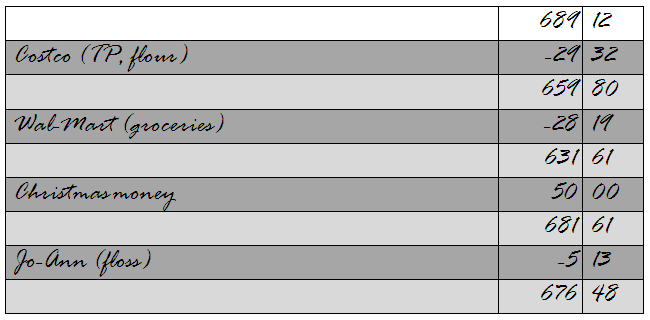

You’ve probably seen people use the method that looks like this:

This method uses a check register. It works, but it’s cumbersome, and you need a separate register for each bank account (at a minimum). It’s also a hassle to use this method to track multiple credit cards. In my opinion, unless you’re using only checks and a debit card, this method is way more trouble than it’s worth.

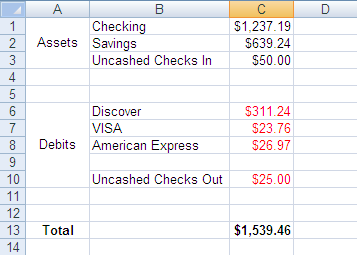

Instead, I’ll be teaching you to use a method that looks like this:

As you can see, it lets you keep track of multiple accounts at the same time. I use Excel, and most of my tips will be centered around it, but Open Office or similar should work too.

At the top of the page, you’ll put your liquid assets. This refers to accounts that you can easily access, such as your checking and savings account, but not accounts which you have limited ability to use, such as a 401(k). You should also include a section to put in any checks you’ve received but that aren’t yet deposited, such as paychecks that don’t go through direct deposit or gifts.

Below your assets, you should put your short term debts, debts that (ideally) you’ll be paying off by the end of the month. This includes any credit card balances and any checks you’ve written but that haven’t gone through yet. Finally, at the bottom, add up the assets and subtract the debts.

And that’s all there is to it! You balance your checkbook by finding out what balance you have available to you.

No comments:

Post a Comment